You have to use the right stop-loss strategy to generate regular income with stock trading. There are many different ways to place a stop-loss in your trading. The right choice depends on your trading style and risk management rules.

The stop-loss placing is not a single once-time task. When your stock trade is open, you have to manage it. The main task is to take care of your stop-loss levels. This activity is important because using a trailing stop-loss technique helps you to gradually decrease your financial risk. And since you reach your entry point by a trailing stop-loss order, you manage only how big a profit you’ll take from this trade.

Tip 1—Use the day of entry as the next base for a stop-loss level

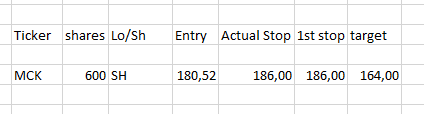

The first placement of a stop-loss order happens when you enter a trade. You have some stop-loss levels already described in your trading plan for a day. Check this trading plan example from my trading plan sheet.

When you enter a trade, you typically place a stop-loss order immediately on a level defined in your trading plan. The key is to manage this level as trade develops. This is often known as a trailing stop-loss technique.

My first tips that I like to use when I think about where to move my trailing stop-loss order for the next day is to base it on the entry-day candlestick.

The best outcome that can happen during an entry day is that the price paints a long-body candlestick with above average volume. This is an indication of a strong buying interest and mood for bullish trades. The best bearish trades have a long negative candlestick during the day of entry.

The calculation of a trailing stop-loss level for the next day is based on the low (for bullish trades) or the high (for bearish trades) of the entry-day candlestick. Here’s an example

Check the example of my long bullish trade I did with FEYE in May 2015. I entered this trade on 28.5.2015, and for the next day, I set my stop-loss below the low of the day, which was 44.845. So, I set my stop-loss for May 29 to 44.83. It was already an improvement of the stop-loss level I had in my trading plan since this was lower (near 44 USD). I immediately lowered my risk in this trade after the day I opened the FEYE bullish position.

The complete video description of this trade is available on my membership club site.

Tip 2—Trail stop only when a long candlestick occurs

I base the second tip on the idea of the long-body candlestick. The importance of long-body candlestick compared to short and indecisive candlesticks is the base for placing a trailing stop-loss order.

When you’re in a trade and your position develops in the expected direction, you should move and trail a stop-loss order only after a long-body candlestick develops. Here’s an example based on a trade I made in September 2015 with ticker CYH.

As you can see on this chart, the price dropped after a breakdown of 51 USD level. I had a short-sell position in CYH at that time. When the price moved down and painted a long-body candlestick, I decided to set a new level for placing a stop-loss order. The high of this down moving candlestick is used as a new level, and you can see it on this chart as a green line.

The price moved down again the next day and created another long-body candlestick. So I used this one again to alter my level for a stop order.

The next two days are characterized as short body/narrow range candlesticks, and so I kept my stop-loss at the level set in the previous step.

You can see on the chart below that another drop happened on Sept. 24, and I again changed a trailing stop-loss placement level at the end of the day. The green line shows this value.

Keep simple rules but be flexible with a stock market stop-loss

These two tips on stop-loss order methods are not the only rules I use to manage my trades. The stock market can be in different situations like high or low volatility, bullish or bearish trend, and it’s good to know when to use which rules.

So, set basic rules into your trading plan and have ideas how to stay flexible when using a trailing stop.

Find more on related pages