Good planning to short a stock is important for realization of good and profitable selling stocks short strategies. Bearish stock trading strategies are an important part of any trading arsenal and I recommend having some of them incorporated into your stock trading system.

There are stock market situations when it is preferable to sell short instead of going long and buying shares. Violent market declines and stock market crashes are ideal opportunities for bearish trading strategies. But bear market moves could also be quiet and slow, only increasing pain for long-only bullish investors.

This pain is the main reason why knowledge of how to sell stocks short for maximal gains is so essential for good and profitable traders and investors.

Bear stock market trend

Market declines are opportunities for traders who are prepared and know how to short stocks. This technical situation occurs quite often and is good environment for bearish strategies selling stocks short.

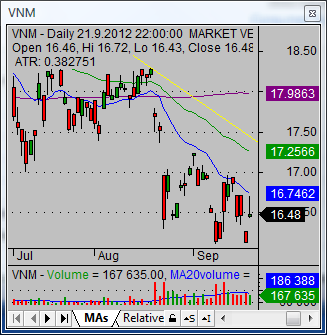

A typical negative stock market situation can be seen on this chart. It is not so complicated to find the prevailing market trend and what trading strategies to use.

Short stock picks with relative weakness

Relative weakness is a very important reason for selling stocks short. Best short stock picks present this weakness on the technical charts. Relative strength and weakness are technical situations that are possible to spot on charts. I personally like to use candlestick charts, as they have most valuable info for my analysis.

Here below I present a typical example of relative weakness that can be seen on the chart of Vietnam ETF. This exchange traded fund for Asian emerging market is in downtrend. Broad emerging market exchange traded fund with symbol EEM presents a much better technical situation.

Selling stocks short in trend reversal

Strong trend reversal is also a very good environment to short a stock too. Such a situation often happens quite quickly and catches many-long only investors or bullish traders in a situation of sudden decline. This leads to some level of panic and shares are going to be sold heavily. This panic selling is a good opportunity to make a quick bearish trade and make huge profits.

You can see an example of such sudden strong reversal on the chart below. Shares of LeapFrog Enterprises Inc. with ticker LF finished their uptrend. Then after breaking the last level of support represented by the 50-day moving average they dropped aggressively from 11 USD to 8.40 USD. They lost 25% in six days. Great opportunity for short selling LF stock.

Find more on related pages

- How to analyze stocks to short using stock short interest

- How to short stock for profit

- Find more details about profitable short sell strategies