This is the oldest index exchange-traded fund on US markets. It was invented to allow easier access to broad US stock market performance. This SPY ETF tracks the S&P 500® Index, which wants to show performance of a broader list of stocks than the Dow Jones index.

This ETF holds more shares in its portfolio. The top holdings for this index exchange-traded fund are today (01/2012): Exxon Mobil (XOM), Apple (AAPL), Chevron (CVX), IBM and Microsoft Corp (MSFT). Only the first two companies in the list have bigger than 3% share in this spy fund. The rest are under 2%.

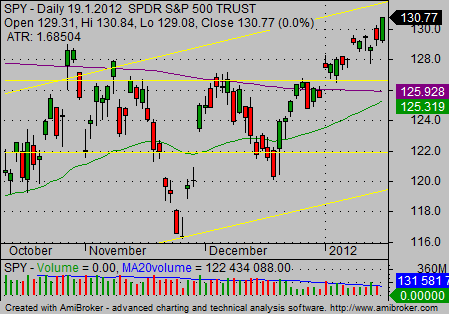

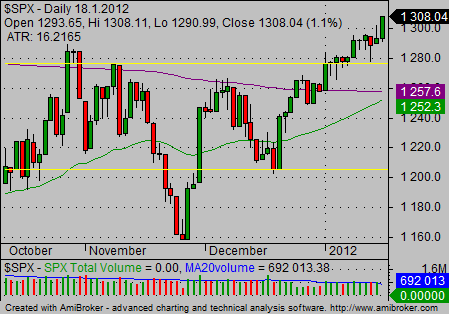

Here is a typical stock index chart of SPY exchange traded fund and also S&P500 index chart.

More S&P500 index funds

There are several alternatives to SPY. Other major providers of exchange traded funds also created ETFs tracking the S&P500 index.

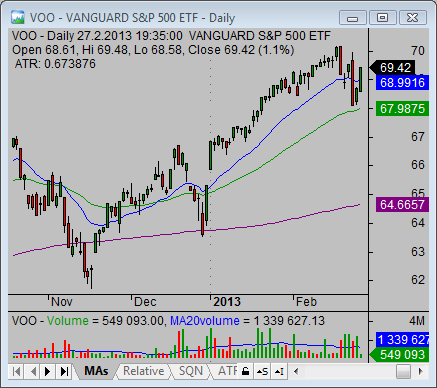

Vanguard issued VOO – Vanguard S&P 500 ETF. This is a relatively young exchange traded fund. But it already gained some attractiveness. The typical daily trading volume is in millions shares. It is still much lower than volume levels for SPY but it can serve as a good alternative for some traders or investors.

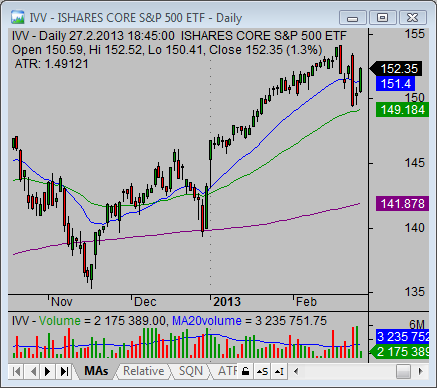

Other major ETF company, iShares, created also exchange traded fund tracking the S&P stock market index. ETF shares of this fund have symbol IVV – iShares Core S&P 500 ETF. The average trading volume is above 3 million shares per day so it can be used also in any trading strategy.

The SPY fund and its alternatives are a good options for any type of trader. It is traded by short term day-traders or swing traders. It is also part of etf portfolio of position traders or active investors. I personally use it a lot.

Find more on related pages

- Major Nasdaq ETF symbols are popular for stock trading

- Explore ideal copper ETF for commodity online trading & investing

- Read more about ETFs