Short selling stock strategy is part on my trading system I use for intraday trades. I base these daytrades on ten-minute intraday charts. I use Esignal as my main intraday charting platform but I combine it with Amibroker, my favorite chart analysis software.

I do not know in advance whether I will do bullish intraday trades or short selling stock trades. I do not make any trade during the first 30 minutes after market open. I want to see in what direction the market is headed before I decide which trade strategy I choose.

Short selling stock trade preparation

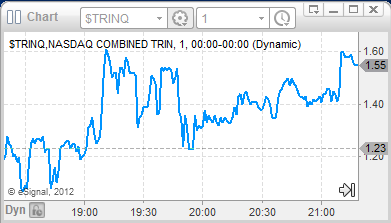

Yesterday, 1.10.2012, the market started on a bullish note and it was confirmed by the TRINQ indicator I monitor. The value held well under 1 in the morning.

The situation started to change around a noon and it turned bearish in the afternoon. TrinQ started to climb above 1. This signals change of mood. I started to look for short selling opportunities.

Selection of best short stock picks

I monitor only a limited number of tickers for my daytrades. I select from them every time I want to make a daytrade. I picked AAPL from my list as it was clearly the weakest symbol in my watchlist.

Looking at the 10-minute chart I have noticed the price of AAPL shares dropped to a significant intraday support level near 667 USD. The breakdown could offer good short selling opportunity.

Trade setup to sell AAPL stock short

I decided to set my entry for this daytrade under the support level. I set it to 666.40. My stop loss level was set above the 667 area, as it should act as a resistance after a clear breakdown. So I used some candlesticks and decided to place a stop loss order at 669.50.

Setting the target is quite tricky for daytrades. I prefer to use a trailing stop strategy for all my daytrades. The trailing stop moves any time a new 10-minute candle is finished. I place a new trailing stop level above the high of last 10-minute candlestick for short selling stock trades or below the low of such candlestick for long, bullish trades.

Trade development

I entered the trade after a strong breakdown of the indicated support level. The price moved in my favor for some time. Then it started to pull back. I moved my stop loss level to 666 and so I was stopped out at this price. The result of this trade was not huge profit but it finished near zero profit, near break-even.

Another opportunity for selling aapl stock short

I monitored AAPL stock after my exit, as I wanted to see whether the resistance level will hold. The TRINQ situation still indicated a bearish mood.

The second opportunity for a short sell trade appeared quite soon. The price reversed on resistance and dropped down. Entry near 665 level with a stop at 668 USD gave the possibility for another leg down.

This happened after some time and price started to decline during the last hour. It finished near 659. It offered the possibility to make a decent profit for this second intraday opportunity.

Include strategy for selling stock short in your trading system. It will allow you to make money on short term trades almost every day.

Find more on related pages

- Inspire by this TCO selling stock short trade example

- Gain knowledge of profitable selling stocks short using gaps

- Understand further steps to make short stock trades