A selling stocks short strategy is part of my trading system. And I think it should be incorporated into a system of every stock trader or active investor. Short selling offers huge opportunities for quick and big profits.

Spotting an opportunity for selling stocks short could be tricky. There are several different ways to find best stock for short selling. The best stocks picks for these bearish strategies could be find using gaps that are shown on an actual price chart.

Why to use gaps for short sell strategy

Gaps represent the big change in the mood of investors holding particular shares. These gaps often catch these traders and investors in wrong direction. They hold shares and a price gap down another day way below the last price.

Most of these traders and investors panic. They are selling immediately after such situation occurs. This creates another pressure for a price decline. Daytraders often use gaps for intraday selling stocks short.

The second way how these wrong footed investors are trying to handle similar situation is the hope and the waiting for stocks price increase to better (understand higher) levels. They hope they will be able to sell their shares at much better price.

This behavior leads to additional selling pressure when a price of such depressed stocks starts to rise. The biggest selling pressure happens near previous support areas. This selling action make harder for stocks to rise above these levels again and these price areas start to act as strong resistance.

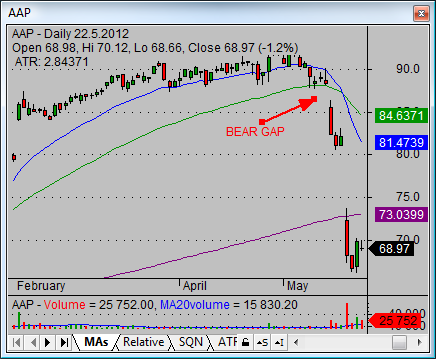

AAP Gap chart analysis

This is example of the opportunity for short selling that can be seen on the chart of AAP shares. 14.5.2012 a price broke down from the rising trend and opened well below major moving averages. All bullish based traders and investors were trapped. Their panic selling created a huge pressure for stocks price decline.

The price declined and after three days another devastating gap occurred. The price opened much lower and under last strong level of support represented by 200 day moving average. Short term traders were able to exit their short sell trades here.

The next rise of the price back to 200-day moving average offered another opportunity for selling stocks short strategy with AAP shares.

DECK short sell using gap

The DECK technical chart represents another example how to use gaps for short selling stocks. The price gapped down and opened well below former support level of major moving average. This support turned to the resistance. The pullback offered another entry opportunity for a bearish trade few days later.

The Entry near the 90 USD level with quite tight stop has produced nice profitable sell short trade with decline of several points.

DECK offered similar opportunity to sell short these shares again in February 2012 when another gap down occurred. Following decline leads shares down to 65. Traders could exit their profitable short trade there.

Selling stock short offers many opportunities how make money on stock exchanges. Include similar bearish strategies into your trading plan. You can use some market screener to find gaps or monitor of your stocks watch list.

Find more on related pages

- Use the most popular index etf shares for profitable short selling

- Swing and day trading rules for every trader

- Learn more how to make money by short selling stocks