My ETF trading strategies are also applicable for other types of etf securities then only sector based exchange traded funds. I monitor also different parts of financial markets as they also offer good trading opportunities for my etf portfolio.

Using etf exchange traded funds I monitor and trade fixed income market, international stocks and stock exchanges and also commodities. I apply similar stock analysis system and principles and also stock and etfs trading strategies as for sector based exchange traded funds

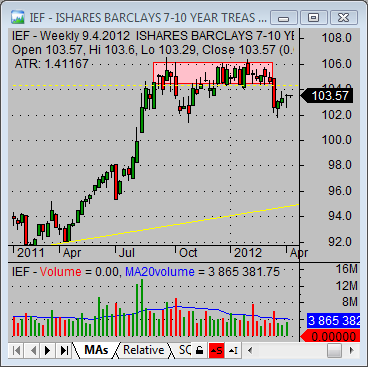

Fixed income market and treasury etf

Bond Exchange traded funds group is based on several bond ETFs. I actively monitor these bond ETF stocks: IEF, LQD, SHY, TLH, TLT, HYG and MBB.

I monitor situation in fixed income market using exchange traded fund that tracks mostly 7-10 Y Treasury bonds. This etf stock market symbol has ticker IEF.

I compare bond exchange traded funds only within this group. I use the bond index fund IEF as key chart for etf trends definition for this group. Afterwards I compare individual stock market ticker from this group on relative strength basis. It is the same method I use also for other etf exchange traded funds I stalk for possible trade.

When I find strong or weak funds, I wait. I do not make the trade strategy setup immediately. I want to see some good stock chart pattern develop or see the price on an important level of support or resistance. Only in such cases am I ready to enter a trade in bond exchange traded fund shares

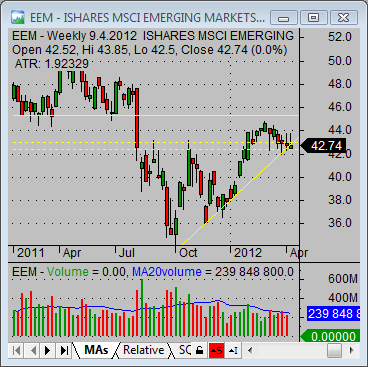

International stock markets in my etf portfolio

Another group of individual fund shares are International ETF shares.

There are a lot of exchange traded funds for specific countries or regions. I personally divide them into these sub-groups: Europe, Asia and the Americas.

I have included these exchange traded funds in my international ETF groups:

- Europe: EWO, EWQ, EWG, EWP, EWL, EWU, GUR, EZU, FEX, RSX

- Asia: FXI, GXC, EWA, EWJ, EWM, EWS,EWY,EWT, INP, PIN and also FXP

- Americas: EWZ, EWC, GML, EWW

Again, my search for the best funds trade setup is based on relative strength analysis within each group. The major base index for most developed countries and their respective etf securities is US stock market index – SP500.

When I want to know broad situation on emerging markets I use stock market symbol with ticker EEM that tracks development of major global emerging markets.

Then I use a stock chart pattern analysis and support/resistance analysis. Trades with exchange traded funds in these two groups has longer duration, typically several weeks instead of several days.

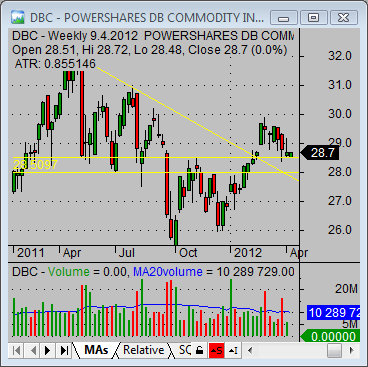

Commodity etf securities

Commodity funds are also included in list of stocks I monitor for possible trade setup. The stock market symbols in my list are DBA, DBC, GLD, SLV, UNG , USO and many more. It is now possible to trade different parts of commodity markets using these thematic etf securities.

I personally track situation on global commodity markets using stock market symbol DBC that tracks broad index of major commodities.

My next analysis and also picking best commodity exchange traded funds for trading is then based on my simple method for selection best etf securities for trading. This method is based on relative strength analysis.

Find more on related pages

- You can trade also Reit ETF ishares funds

- Water ETF trades generate nice gains

- Gain more know-how about ETF Trading