Many active investors would like to have a best buy stock list that will help to find the best stocks to buy for their investment strategy. Many active individual but also professional investors use market strategies that look for large, mid or small cap growth stocks.

Basic stock market definition for growth stock tells that these stocks represent companies that expect high revenue and earnings growth. The level of rise in these two important fundamental values is expected to be much higher than the levels that have to be achieved by its industry or global market.

Such a best buy stock does not pay any dividend and if you are looking for dividend paying stocks you have to select totally different parameters. Every growth stocks strategy expects to make money by rise in price of shares instead of some dividend income.

The picking the best shares for an investment strategy could be a tricky issue and so many passive investors leave this task to professional managers that manage growth stock mutual funds. It could be good for a passive investor to select some good growth mutual fund but I think that passive investing is not very good choice if you want to make exceptional money by value or growth stock investing.

Typical examples for best growth stocks

Typical high growth stocks are found these days in the technology area. These companies prefer to increase their fundamental values and use generated earnings for further expansion of their business.

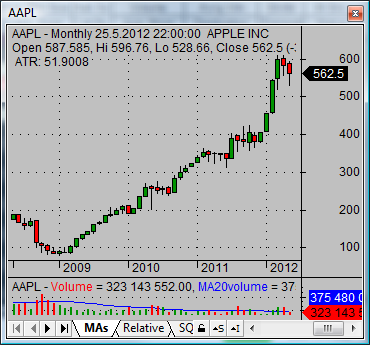

Many growth stocks were formerly little recognized by investors and happened to become famous after some strong rallies already started in the pricing of these high growth stocks. One typical example is AAPL, which came into the investor spotlight after years of problems and troubles. This company changed its target and vision and came up with products that created almost a new type of market for digital products and hardware.

Investors that found the quality of this company before it started to be known as a famous idea for investing enjoyed huge reward in multiplication of the price of AAPL shares.

Three basic criteria to find best buy stock for growth stock investing

The first fundamental parameter to be checked is revenue growth (Historical and Estimated). The growth in sales and revenue is the ultimate indicator of how a company manages to create new business and growth. Therefore, it is important to track “top-line” growth. Increase in earnings is not enough if it is not accompanied by increase of revenue. Companies with earnings but without enough revenue growth will finish sooner than later.

The second one is tracking earnings per share (EPS) development (Historical and Estimated). By checking the EPS values you get a “clean” measurement of earnings growth adjusted for any changes in number of shares outstanding. This value is used by many analysts, so it is one of the core values that could be used for comparison of growth stock market companies globally.

Finally, the last important value to be monitored is net profit margin. I have mentioned above that growth has little value if the company can’t generate profit from that growth. So you have to select companies with some decent value for this parameter. It can be quite a volatile value so selecting a good level for this value is a little bit tricky.

Incorporate some technical stock analysis parameters to your selection of high growth stocks

One of the basics of stock market investing when using only fundamental criteria is that the market sentiment and investor opinion could be on the other side of your investment expectations. So you can experience a long time period of price decline or no price increase for your fundamentally selected best buy stock in your best 1 growth stock strategy.

The solution for this problem is to use some form of technical analysis parameters that allow you to monitor your best buy stock without any action until the time when the stock price of your best preferred stocks starts to show signs of a new rally.

Find more on related pages

- Learn to find the best dividend stocks for defensive situations

- Learn tips how to invest in silver

- Collect more knowledge about good ways to invest money