Your trading plan defines what type of exit strategy you use. The exit strategy can differ for any trading style you use in your trading or investing. You probably close your day trade different from your position trades that last several weeks.

When to use a stock exit strategy

Use exit strategies during two major periods:

- When your position reaches a target price area

- When the position changes the direction and starts to move against your expectations

Exit trade when the price reaches a target price area

The best situation is when the trade reaches your target price or is already quite near this price. The trade worked well until now, and it’s time to take a profit.

The best approach to take a profit is to sell the position into the trend. This means that as the price moves close to your target, use a sell order to close your position if you’re in a bullish trade. You have to use a buy order to close a short-sell in a bearish position.

This approach is sometimes known as “selling too soon.” You can see that the price could reach a little bit higher after your exit, but don’t blame yourself; it’s OK.

Here, I recommend avoiding any ideas about letting a position move and expect more profit. Although it can happen sometimes when the trend move is really strong, I haven’t a good experience with this. My trading journal provides a lot of statistics that most of my trades never moved much longer in my favor when they reached the target area.

I have set targets into levels that were hard to beat during my single swing trade. I don’t want to hold a position for many months. I prefer to close a trade at my target and move cash to my account. And if the ticker offers another opportunity for a trade, I prepare a new trade setup and trade it as a separate trade.

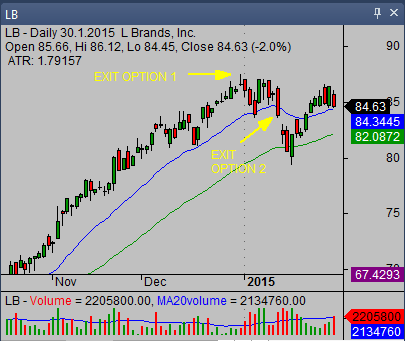

Exit trade when price movement reverses

This is a situation when your trade hasn’t reached the price target yet, but the price reverses and start to move against your plan. That means that the price starts a pullback. This pullback could be only a rest in a major trend. If such a pullback is deeper than you expected or you can accept it, then it’s often the second option—a complete trend reversal.

This is a situation when your trade hasn’t reached the price target yet, but the price reverses and start to move against your plan. That means that the price starts a pullback. This pullback could be only a rest in a major trend. If such a pullback is deeper than you expected or you can accept it, then it’s often the second option—a complete trend reversal.

You will use your stop-loss orders for exiting your stock trade. Your stop-loss orders are in your broker’s trading system. These orders protect your profits if your trade moved enough in your favor. Or they protect your trading capital against big losses if the trade doesn’t work well.

Finally, understand it isn’t possible to have only profitable trades. The trading is about taking profits from profitable trades and taking small losses from trades that don’t work well. The stop-loss orders stock exit strategy is essential for profitable trading.

Find more on related pages

- Find the best trade exit strategy

- Five rules for using a stop loss order to protect gains

- Learn more about stock trading system development