Harami candlestick pattern is not so powerful like other two candlesticks combinations. But even this it is quite popular between stock traders and and currency (forex) traders use it for their trades. Because when it is used properly, its significance increases.

Harami has two versions, the bulish harami pattern and the bearish harami pattern. This pattern is based on combination of two candlesticks, one with long body and second, much smaller one. The location of second – smaller – candlestick is inside of the body of previous candlestick and it is important. This position and also that second candlestick is in opposite direction than previous – longer – one is a hint that trend is going to change.

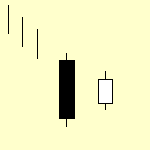

Bullish harami expects that a pullback is already over and new uptrend move could start soon. Long black candlestick is followed by small white candlestick.

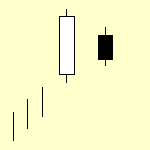

Bearish harami indicates that a small bullish pullback in bear trend could be over.

Harami candlestick trading ideas

The main idea behind this candlestick combination is that this pattern indicates possible reversal of previous – often small – pullback. Creation of this pattern should warn you that it is possible to expect new move in the direction of prevailing trend.

The first chart shows how to find bullish version of this pattern on candlestick chart

The second example shows examples of negative, i.e. bearish candlestick pattern.

It is not easy to use this pattern as single signal to create trading setup. The best way is to combine this pattern with other valuable tools of technical analysis, especially support and resistance levels and moving averages. If you can combine them together then you can prepare trading setup for bullish or bearish type of trade.

Using candlestick patterns requires flexibility as typical textbook version of harami pattern is not so often on the chart. The two charts above confirm this idea.

Find more on related pages

- Shooting star candlestick pattern trading ideas

- Hammer candlestick pattern meaning

- Read more details about candlesticks