You should not trade without a using of protection provided by a stop-loss order. I recommend it as I learned several lessons in the past how it can be bad to trade without a good stop-loss policy in any market strategy.

Why to use a stop loss order for stocks

The basic statement is that it is not possible make only profitable trades. If you are looking for knowledge how to trade without loss then it is almost like search for holy grail. The key in trading is to minimize loses in failed trades and maximize profits in winning traders.

My personal journal statistics presented me very interesting information regarding winning and losing online stock trades. I can make less winning trades than losing trades and make money! Yes it is possible.

I usually do slightly above half of winning trades but the key to make money in trading is to contain failed trades with smallest possible losses.

Key rules for a stop loss order

- Do not enter your trade if you do not know your max. risk level.Plan your trades. Every trade must have defined entry, stop loss and target levels before you enter trade.

- Place the stop-loss order immediately after you enter the trade.I enter this exit order immediately after I enter the stock trade. I do not use a mental stop. I want to be out as soon as my stop-loss level is hit. Any more thinking is the way to bigger losses.

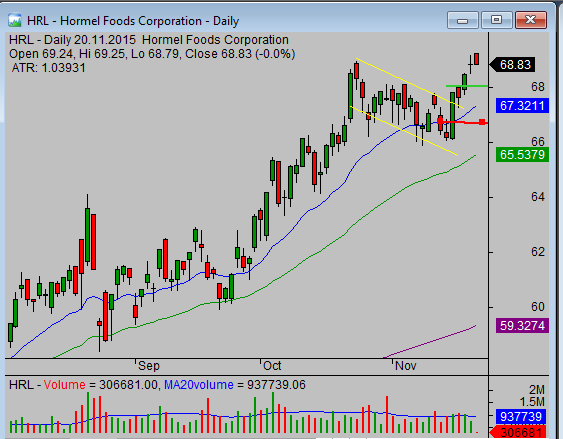

stock trade entry and stop loss level example

- Regularly evaluate and monitor your trade and trail your exit level.Monitor your open trades. Move your stop-loss order into more favorable

levels any time you see that trade is moving enough in right direction. Prepare several rules for moving stop-loss. - If you are day trader, then use a trailing exit order.Daytrading is a very quick style of trading, and therefore, using a trailing exit order is a good solution to use your computer to automatically move your exit level in the right direction.

- Define your stop-loss strategy for special purposes like gap down or gap up open.Open time is a special case for stock markets. Sometimes the stock opens with a gap; it’s when the opening price is much different from the previous closing price. It can be much worse than your exit level. So it is good to have a prepared special set of rules for how the situation will be handled.

Three ways to place stop loss order – video

Always use stop loss

And finally remember, the first selected stop point is usually the BEST stop-loss level.

Any time I tried to avoid my stop-loss level I prepared in advance, I was beaten. Every time I thought that the price would return to the previous level, I suffered a bigger loss than I planned. It’s not good to use hope in your trading.

Find more on related pages

- Read about using a trailing stop in stock trading

- Inspire by these ideas how to trade iShares etf

- View other stock trading tips