Beta coefficient is technical analysis indicator which can be used for selecting momentum picks for momentum day trading strategies. It is one of technical indicators that are not directly used in equity market strategies. Instead this is one of technical indicators that can be used much better for a risk management purposed and also in a trade management process.

This value is simply the measurement of the volatility of a specific instrument. The higher the number is, the larger the moves you can expect from the instrument (like stocks). If the Beta value for a ticker is 1, it means that the stock will make similar moves as the markets do. If it is 2 or 3, then you can expect the price makes large intra-day moves. Opposite stocks with low beta value are good vehicles for investors who do not prefer big swings in stocks price and portfolio values.

Free market screener for volatile stocks

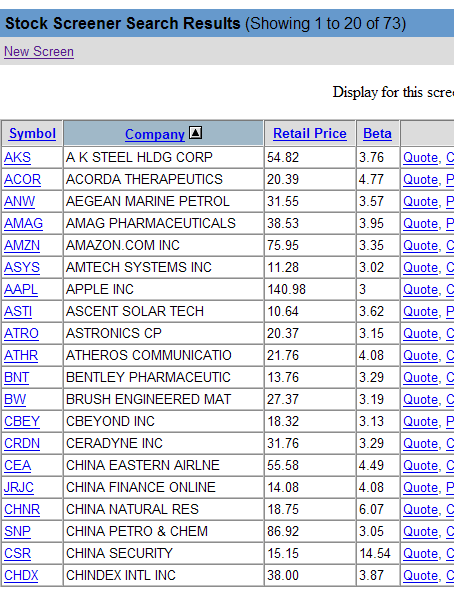

A very good tool for selecting tickers with high or low volatility coefficient value is a free Yahoo screener. Here’s an example of a free screener result looking for U.S. stocks with a beta higher than 3 and a price higher then $10 USD. It found 73 results.

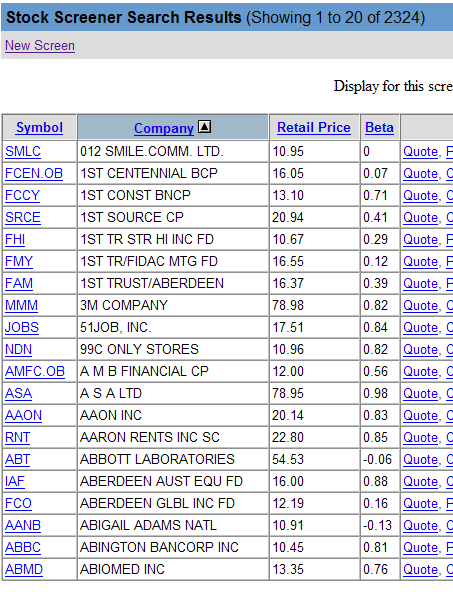

The second example is the result of free market screener looking for U.S. stocks with a beta value below 1.

High beta screener for best day trading stock pick

There is possible to create screener of highly volatile stocks for day trading. Such free screener can be found on some good online trading sites like FinViz or ChartMill. Just find the parameter describing this coefficient.

How to trade stocks with high beta coefficient

This beta value if often used by short-term stock traders. If you prefer daytrading as your style, then you would like to trade ticker with higher than normal volatility, with bigger value of this coefficient. These tickers move in bigger swings during intraday hours. They offer much more daytrading opportunities that can be turned into a profitable trade than stocks with low volatility, low beta.

But bigger beta value means also higher risk. It is important to apply money management rules accordingly. Volatility should be used for money management and position trade management for daytrading strategies but also for swing or position trading strategies.

Find more on related pages

- Way to find todays market opinion: bullish or bearish

- Three ways to learn stock market secrets

- Read more stock market trading tips