Investing into the best dividend stocks is often published as a sound investment strategy. But it is not easy to find a list of the best dividend paying stocks.

Here are ideas from my friend, a stock analyst about dividend stock investing.

Two key issues for dividend stocks

In order to pick the best dividend stocks, one should look at multiple criteria:

- sustainability and growth rate of dividends

- frequency of dividends

In terms of sustainability, one really must pay attention where the earnings come from and what is the earnings power of the company. Is the company dependent on government spending? Is the company dependent on over-levered customer? Are the competitive forces squeezing margins of the company? Are there any structural or demographic forces as a tailwind for the company?

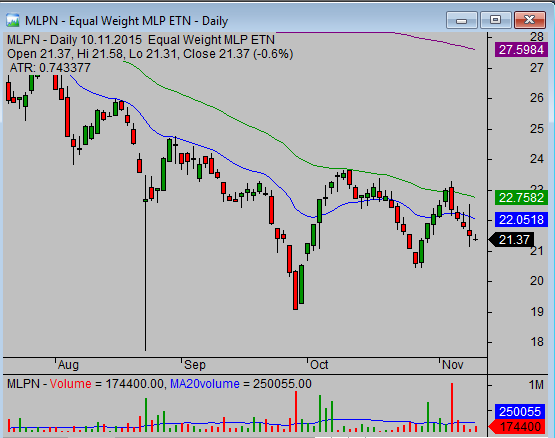

One really needs to pay attention to these questions in order to make good long term investment conclusions. We still prefer (Sep. 2010) being long master limited partnerships in US that have exposure to natural gas transportation (EPD, PAA, KMP, etc.) , one cay play this theme through MLPN etf.

Frequency of dividends

The frequency of dividends is a crucial to us as well as it gives us some space for maneuvering and tactical shifts of holding the asset. In these terms, US multinationals and large caps are positioned the best – they are best dividend stocks. Look for companies with growing free cash flows, exposure to emerging markets and dividend yields north of 3%. Looking for yield, one should also think a bit outside the box.

When running screener, do not pay attention only to dividend yields, look also after share buybacks.

Company like IBM can for instance offer only 2% dividend yield, on the other hand, it has been buying back stock on a permanent basis for many years, returning money to shareholders at effective rate north of 6-7%. So one gets not only dividend yield, but also capital gains as well. Stock buybacks should be very crucial point in your further research.

REIT ETF pick for dividends

Another story we like for short term is leveraged REIT companies in US that invest into mortgage backed securities on a leveraged basis. As long as short term part of yield curve remains extremely low (and it should for next few years) and households do not refinance too much, these companies get fancy returns on their equities (yields at 15% gross, though a bit risky over long term).

The modern finance and surge of ETFs allows retail investors get a nice and cheap exposure to bond markets as well. As we are strong believers in diversification across multiple asset classes, there is a profound reasoning for having exposure to bond markets as well, we especially like emerging market bonds ETFs that offer yields of about 6-7% (look at EMLC).

Find more on related pages

- Best etfs for dividend and high yield

- Check also Reit ETF ishares funds

- Check other ways to invest money