Here I would like to tell you what is an etf advantage for short add mid-term traders and investors. Why I like to use exchange traded funds in my personal stock market strategies that makes money.

I personally found these four major advantages

Many possible choices

Many exchange traded funds were created during the last decade. They track every major or minor stock market index or sectors indexes. You can find exchange traded funds tracking commodities, currencies and even some exotic indexes like the volatility.

It is not necessary to create a basket of stocks if you want to trade a particular part of the market. Now you have to find only the most suitable etf.

No problems with liquidity

What is an etf liquidity? It is a common question from traders who don’t know about ETFs. The average trading volume is not so important when using exchange traded funds.

These funds are synthetic instruments and their price is always calculated from underlying basket of stocks in their portfolio. The bid and ask moves in accordance with this intraday net asset value for the fund. The bid and ask size is always large enough to cover our buying or selling needs.

The risk is reduced

Exchange traded funds are baskets of stocks. It means that every individual stock in the etf portfolio moves the etf share price only a little. This eliminates a big risk associated with individual stocks which can make huge overnight moves based on news, earnings or upgrades and downgrades.

This feature allows to trade exchange traded funds also during an earnings season without too high risk.

ETFs for bearish strategies

Shares of exchange traded funds are shortable like all other shares available on the stock market. So you can use them for bearish stock market strategies.

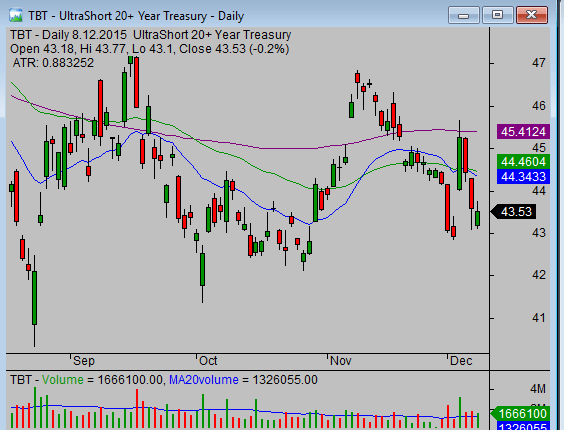

Inverse ETF TBT

And there is one more feature. There is a huge list of inverse etf tickers that rise in price when underlying index declines. So it is possible to buy inverse ETFs instead of short-selling standard exchange traded funds.

Find more on related pages

- Learn about major ETF funds families

- Name major Nasdaq ETF symbols

- Read also about other ETF you can use for protiable trading