Vanguard index funds are popular for buy-and-hold long-only investors. But today’s economic environment is not very friendly to this type of investing. It could be much better to be more active when doing business on stock markets.

This does not mean that one has to be a daytrader. It is fine to be a position trader or even an active investor. The holding period should be lowered from decades to months and weeks. Today’s volatile markets are very tough for long-only buy-and-hold investors.

Therefore I think it could be good to think more about an alternative to these mutual index funds. These funds could be easily replaced by exchange traded funds also produced by Vanguard. Or select another provider of ETF like Ishares ETF provider.

What are differences between vanguard index funds and ETFs?

ETFs are like stocks. They can be easily bought and sold using any brokerage account. You can use your best stock broker to buy and sell these exchange traded funds.

Market price of ETFs fluctuates throughout the trading day. Mutual index funds are priced once a day after financial markets close. Using ETFs provides much more flexibility. Most exchange traded funds have lower operating expenses than traditional mutual funds.

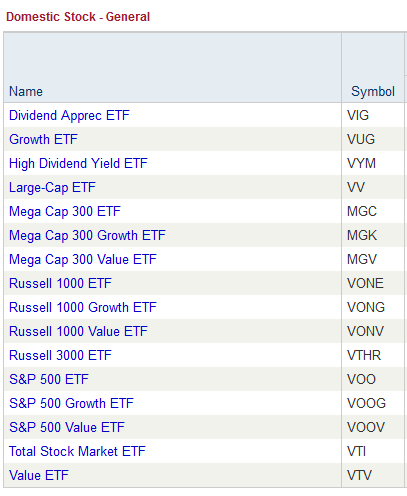

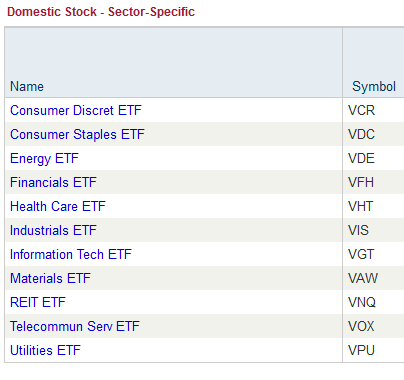

List of ETFs available

Vanguard mutual funds can be replaced by using their exchange traded funds alternatives. Vanguard company offers stock and also bond funds. Stock-related exchange traded funds track general indexes but sector-related funds are available too.

Better index investing with Vanguard etf trading strategies

Vanguard ETF shares can be used in a similar way I use another groups of exchange traded funds like iShares ETF or Powershares ETFs. The concept of technical analysis and relative strength analysis can also be applied to these vanguard instruments.

Here is an example or relative strength analysis of two vanguard ETFs. The current situation with the S&P500 index is not very bullish. But relative strength analysis can present the utilities index as a relatively strong index, i.e. active index investing should prefer utilities – ticker VPU – if there is a need to buy something.

Find more on related pages

- Read best books to learn beginner stock market investing

- How to find the best silver stocks to improve results of silver investing

- Explore more ways to create wealth using the stock market