When you decide to base your trades on data, you have two options. Either you go for the fundamental analysis or the technical analysis. A lot of traders decide for the second one, and then try to understand to trends and patterns in the chart. Understanding candlestick charts and patterns is crucial for achieving success this way.

When to prefer candlestick charts in technical chart analysis

Every single candlestick on price graph provides a lot of info for an analysis of the share price. Using candlestick analysis basics together with important candlestick patterns and other basics of technical analysis leads to the creation of a profitable strategy to make money on US exchanges. Learn more about situations sufficient for candlestick chart pattern usage.

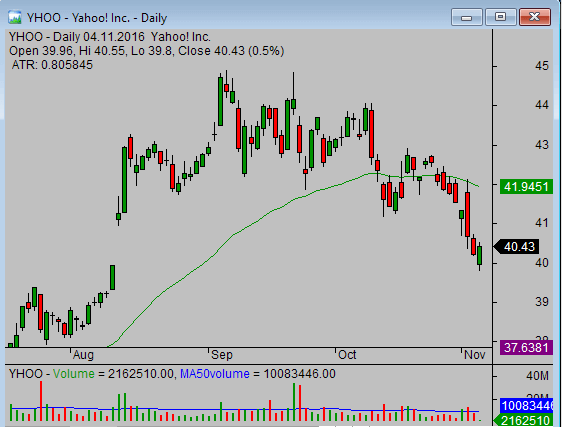

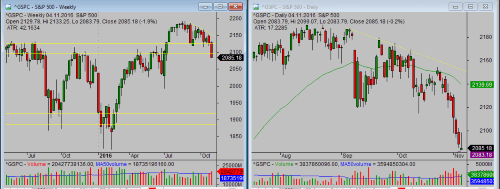

The best layout setup for candlestick stock chart analysis

Your trading results will improve if the design of candlestick stock chart will be the best for your trading style. When you can read and understand candlestick charts that is presented on the computer screen, then you will be able to make a correct decision. You will have your stock trading strategy profitable. Learn more about choosing the best layout for your trades.

Click Here to see larger image

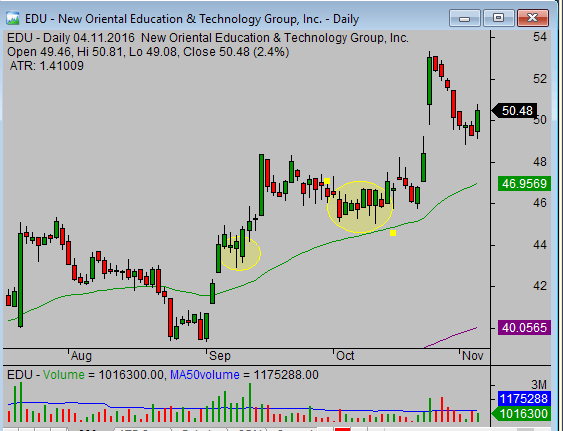

Hammer candlestick pattern meaning and strategies

Hammer candlestick is one of the most important candlestick patterns that you can use for your trading. This single candlestick is used by many traders to trade stocks, ETFs, commodities, and forex. A common trading strategy that uses hammer candlestick uses trend moves. This approach is named a pullback trading strategy. It expects that the price is going to rise after this single candle pattern occurs at a support level. Study step by step guide to trade this very frequent candlestick chart pattern.

Understanding candlestick charts leads to more profitable stock trades

When done right, candlestick pattern is generally one of the most reliable patterns to follow in your trading. But do not ever get overly excited when you find a nice pattern, keep in mind to follow all your trading rules. Only that combined will lead you to fantastic results.