Risk reward ratio is a very important stock market definition. Every trader must have this value set in his market strategy and system. This simple formula is a little secret of profitable traders. It helps you to move trade probabilities in your favor.

This is one of key terms that helps to do good stock market risk management. And risk management is key part of profitable trading. You can be great picker but without good risk management you will be losing money.

Stock market definition for this risk management tool

The definition for this key value is simple:

The profit (reward) value for every trade setup must be at least three times bigger than the risk value.

Simply put, if you expect to make a profit (your reward) of $3 USD per share in a trade, you have to risk $1 USD per share as maximum.

This trading secret about best reward looks easy, but a lot of traders break this rule, and then their results are bad.

There are plenty of other trade opportunities. You can find good picks offering better reward on the market every day.

When you trade only trades with the potential reward of $3 or more times bigger than the taken risk, your result will be stock trading with regular monthly income.

Later, as you develop a longer history of your real trades, you’ll be able to make small modifications of this ratio to value that best fit your market strategy. Your trading journal or trade accounting software will provide you enough reports to do it.

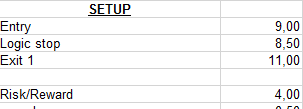

It’s an easy to check if your trade setup fits with your risk/reward ratio. Simply use a spreadsheet with formulas.

Sample risk reward ratio sheet

Example how to use spreadsheet for your risk/reward ratio calculation is described on money management page.

Check this ratio during trade development

I have described above how to use risk reward ratio when you prepare trade setup for your market strategy. But it is not last time you use these formulas.

You have to use this ratio also during trade management process. As you have position already opened, you have to manage it accordingly. It means that you must trail stop loss level based on your trailing stop rules and also you must take profits.

Risk reward ratio is used when you think about new trailing stop level. It is always good to have this ratio better then 1:1 as your position is developing and you want to trail stop.

As your position is closer and closer to your expected target, trail stop to have risk smaller then possible reward. Always check this ratio when you do regular analysis during your daily trading and analysis routine.