Morningstar ratings is quite a popular tool used by buy-and-hold-investors into mutual funds. Their star rating allows a lot of investors to shirk the responsibility of pre-selection of good and bad options. Buy-and-hold investors often do not want to take time to study what they buy.

But what are Morningstar ratings about ? It is a rating system created by Morningstar Inc. that ranks mutual funds based on their risk-adjusted performance over various periods. 5 stars is the best, 1 star is the worst.

Morningstar rating is about past performance

As you can see, Morningstar ratings is about past performance. But almost every document about investing can tell you the basic truth you must understand in the investing process:

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS

Most buy-and-hold investors want to invest only in products that that have four- or five-star ratings from investment researcher Morningstar. They believe that their ratings guarantee them quality and future results.

But there is one hidden rule about mutual funds. They do not make money in bear markets. They are long-only funds that are almost totally invested at all times. They often compare their results to some benchmarks-i.e. to some index like the S&P500.

So if the S&P500 is down more then 20% and any fund is down only 15% , they tell investors – “We are winners, it is a success”. But they are losing money !!! Do investors really want to invest this way? These ratings do not help to solve this.

Be more active in buying and selling index mutual funds

I advocate for being a more active investor than rely on Morningstar. As any one can see from historical stock charts, it is really possible that a lot of investors do not make any money with buy-and-hold long-term investing. Today’s market and economic situation is much more uncertain. It is quite impossible to predict what is going to happen over more than a one year period.

An investor can stick with his/her index mutual funds. I would prefer to use exchange traded funds, as they have lower expense ratio but it is on every individual investor what he or she likes more.

Use technical stock market analysis to time your entries and exists

What does this mean? It is not necessary to be very active. I would like to recommend learning technical stock market analysis basics and learning when to be invested in and when to sell. It provide better hints than Morningstar ratings.

Do not be afraid to take profits from the table. It is much better to buy and sell several times during a 5 year period and take profits every time than see drops of 20% and more as profits vanish. It is important to understand that any profit is real only AFTER the investment or trade is closed!

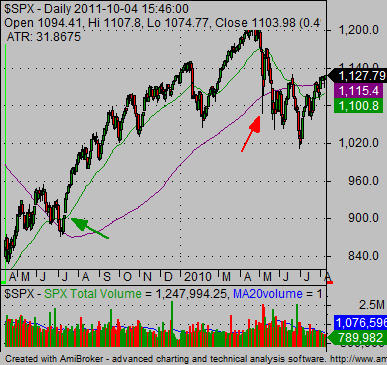

A simple tool for timing these steps could be using stock market price chart of the S&P500 index together with moving averages. And the simple rules are:

- BUY when price of index moves above 200-day moving average and also 50-day moving average moves above 200-day moving average

- SELL when index drops below 200-day moving average.

Examples from the last few years can be found on these two stock market price charts:

Find more on related pages

- Explore the best gold stocks, gold miners & gold etf

- How to use vanguard index funds for active index investing and trading

- Read more about best ways to invest money