The Copper ETF is one possibility for trading or investing in this metal. This commodity ETF tracks copper prices – currently the Copper High Grade futures contract traded on the COMEX. I have this metal exchange traded fund in the ETF List I actively monitor and trade in my ETF Trading strategies.

Copper prices are frequently mentioned in the latest stock market news as many investors tend to use copper prices as an important indicator of economic activity. Well, it can be useful for a global macro economic overview for every investor. Prices of copper or copper stocks are also mentioned in special day trading news that is read by traders that do commodity day trading.

Information about the price of this base metal is quite useful for commodity online trading that could also be performed in longer-term period by swing traders, position traders or active investors that could hold a position for a few months.

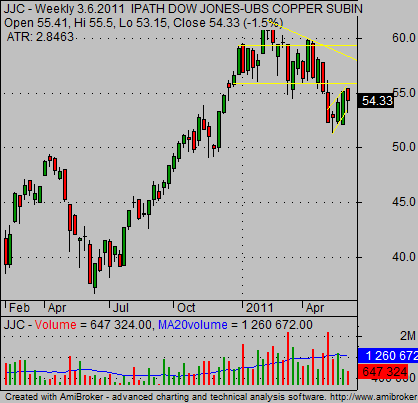

JJC – exchange traded fund for copper commodity online trading

This base metal exchange traded fund that I have mentioned above has the symbol JJC and is traded on US Stock exchanges. Here is a chart of this commodity ETF JJC:

Ideas for trading commodities online with Copper ETF

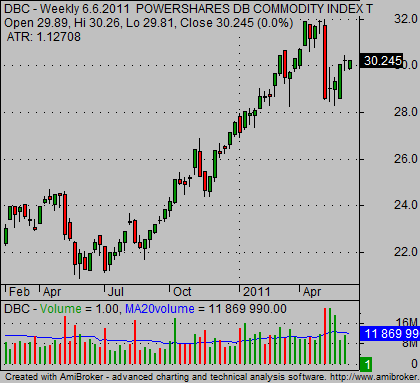

I like to use my relative strength analysis when I prepare trade setup for this commodity ETF. I monitor general strength or weakness of the global commodity sector. I use commodity exchange traded fund with symbol DBC. Here is a chart of DBC

Next I compare it with the industrial metals ETF (symbol DBB) which is one of the commodity exchange traded funds. This commodity ETF tracks several industrial metals – aluminum, zinc and copper (grade A). You can use it as a proxy to trade these metals. Chart of DBB:

When I apply the relative strength method I try to find out if copper should be traded on the long side, on the short side , or not traded at all.

As you can see from the charts above, this metal exchange traded fund is relatively weak to the general commodity index. So I think about initiating a short sell trade in this industrial metal ETF.

There is strong resistance near the 55-56 USD level. I see two possible ways to trade this short selling opportunity.

The first one is to wait for a pullback to the resistance area: 55 – 56 level. As soon as you notice reversal candlesticks in this area you can initiate short selling of JJC with a stop loss level above the resistance of 56.50 – 57.00 USD.

If the trade develops as expected, i.e. the price of JJC drops, then you should move your stop loss to a lower level.

The second possible entry point into this short selling trade is when the price of this commodity ETF will break down from a pullback channel represented by a bear flag. It is also possible to see Head-and-shoulders bearish stock chart pattern on the weekly chart of JJC above.

Find more on related pages

- Commodity ETF stock trading strategy for precious metals ETF stocks

- How can copper prices affect stock market online trading

- Find more about Commodities and ETFs