It’s always useful to have the possibility to trade foreign stocks. These stocks are primarily listed on their local exchanges. But how can a trader trade them? Do you need to have trading access to every international exchange worldwide?

No it isn’t necessary. It’s possible to trade international stocks on the American markets.

Yes US markets are biggest and most liquid stock markets in the world. There are so popular that many of international stocks are listed not only on their local exchanges, but also on American stock exchanges.

Trading of these stocks in USA is better form of foreign online trading then direct access to local exchanges. There is quite good protection of individual investor in the USA. There is also easier to manage risk with trades on US stock exchanges then individual trades on foreign exchanges.

But if you prefer to go to local foreign exchanges then best stock brokers from the USA or Europe offer also such a possibility.

Foreign stocks listed in the USA

The first possibility is to simply find U.S. listed international stocks available for foreign online stock trading. There are some international stocks that are primarily listed on U.S. stock markets instead of their local markets.

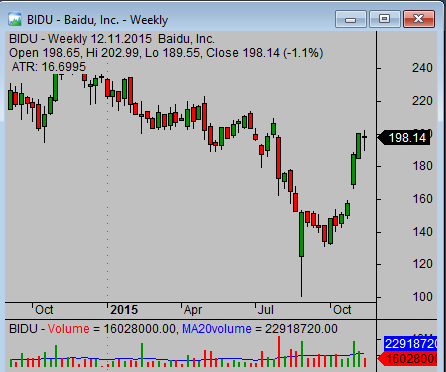

You can easily find canadian stocks that are traded in the USA or chinese stocks listed on major american exchanges.

The second possibility is to find an ADRs.

As mentioned on Wikipedia: “An American Depositary Receipt (or ADR) represents the ownership in the shares of a foreign company trading on US financial markets. The stock of many non-US companies trades on US exchanges through the use of ADRs. ADRs enable US investors to buy shares in foreign companies without undertaking cross-border transactions. ADRs carry prices in US dollars, pay dividends in US dollars, and can be traded like the shares of US-based companies.”

As you can see these ADRs could be placed into your portfolio and represent the best dividend stocks from foreign markets.

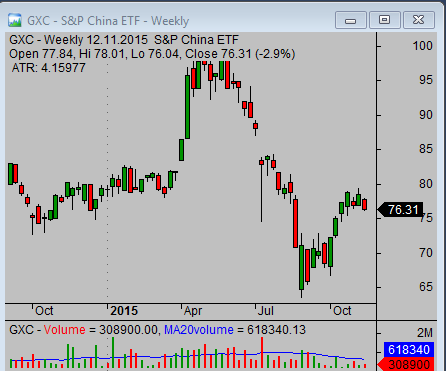

International ETFs

Another possibility is to use an advantage of International ETF stocks. These funds represent baskets of stocks pertaining to the specific foreign market. There are already International ETFs for a lot of countries and practically every region is covered, Europe, Emerging Markets, Latin America, Australia, Asia and more.

US ETF tracking Chinese stock market

Local stock exchanges

And finally another possible solution is to find some brokerage firm (preferably a discount stock broker) that has access to a lot of international stock exchanges. There are such firms in the U.S. and also in Europe or Asia.

Find more on related pages

- How to invest in china stock market

- How to create canadian stock charts for canadian stocks trading

- Check also other stock market trading tips