Index ETFs can be used for every-day fund index trading. They can be used in swing trading strategies, but these index ETF shares could also be utilized for profitable daytrading strategies.

There are plenty of index ETF shares available for traders and their strategies. Different providers of exchange traded funds issued products that tracks same index. The most usable indexes for trading are S&P500 index, Nasdaq 100 index, Down Jones Industrial Average index and Rusell 2000 index.

It is important to select suitable index exchange traded funds to be able to trade them during one day. The major points are good liquidity and good spreads. Based on these parameters I would recommend using only these index ETFs: SPY, QQQ, DIA and IWM for daytrading strategies.

Index fund day trading basics

The core of my every-day fund index trading strategy is to use two major US index ETFs. They are QQQ – PowerShares QQQ Nasdaq 100 index exchange traded fund and SPY – SPDR S&P 500 index exchange traded fund. These two funds could offer nice daytrading opportunities several times a week and in some cases also several times a day.

Click Here to Download My Current List of Stocks for Daytrading

Relative strength in day trading strategies

The core of my S&P500 and Nasdaq 100 index fund day trading is built on using relative strength. Comparison of these two ETFs during first minutes of the day will determine which one is weaker and which one is stronger. The next step is to decide what the prevailing mood on the market is, if the market prefers to go up or to go down. And the final step is to find a good setup and realize the trade.

The major expectation is that when the market mood is bearish and we enter a trade in the weaker ETF then we could expect bigger and quicker movement and have profits in our pockets quickly.

A similar rule is used for stronger fund when the market mood is bullish.

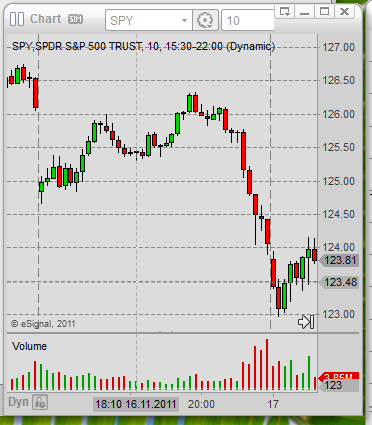

Here is an example of a situation of SPY and QQQ intraday:

The correct strategy is to go short QQQ as the general trading mood is bearish. Any daytrader should find the best possible entry. One can be when QQQ will achieve a new low for the day. Then it is possible to expect further drop in the price of QQQ. We can see the result of such a trade on next chart:

QQQ did nicely almost a 1-point drop. It was a good opportunity for daytraders.

When to not trade index ETFs

I personally do not like to apply this type of day trading index ETF strategy when the stock market has already moved a lot during pre market hours and the market opens with a big gap up or down. I feel that the emotions in the moving market are already exhausted by this huge gap movement and so there is not much left for regular US stock market hours trading.

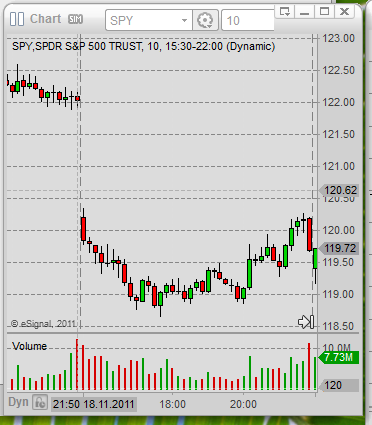

You can see an example of such action on the chart:

There are some day traders that use special techniques for gaps. These gap day fund index trading strategies are based on an idea that most of the gaps tend to close. It is that price from the open tends to move back to highs or lows of the previous day.

Click Here to Download My Current List of Stocks for Daytrading

Find more on related pages

- View more about SPY ETF

- Prepare to become profitable pattern day trader

- Read more about daytrading know-how