Every trader and investor wants the best results from electronic stock trading. It basically means that their stock market trading systems should be profitable and should generate expected results in a specified period of time.

There could be different expectations for electronic stock trading systems. Short-term day or swing traders would like to have every month profitable. Mid-term investors or position traders would target a longer period of time. They will target quarterly or 6-month periods. They will not calculate results for every month, as their trades could last more than several weeks or months.

Risk and money management in electronic stock trading

There are several key stock trading terms that can help to achieve these expectations. I am not going to discuss stock picking now. Picking is an important part of any market system but there are also other important issues that should be incorporated into a good plan for any trader.

Trade results of market systems

There are four possible results for every trade. Risk and money management rules together with proper trade management techniques help to achieve the best outcome for every trade.

Most traders and investors think that the most important aspect to achieve profitable results in electronic stock trading is to have all trades be profitable. It is mistake. The key element of profitable investing is to understand that losing trades are inseparable to profitable trades. Every trader will make trades that produce gains and trades that produce losses. It is not possible to make only profitable trades !

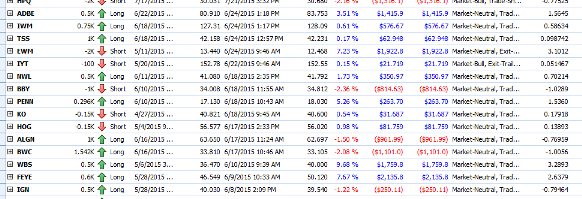

Trading journal helps in stock trading

The key is to understand it and act accordingly. Every trader or investor should understand that it is not possible to predict what will be the final result of any individual trade. Based on this knowledge it is possible to manage every trade individually in accordance with trade management rules.

So using stop loss and other risk management techniques is a key.

Most profitable traders and investors often have only 50% of all trades profitable. My personal experience based on my stock market journal entries is that even when I do only 30% of profitable trades I am able to avoid losing period.

As you know there are better periods and worse periods in trading. It is not always the same. It is quite common to have more quite neutral periods when trading profits will be minimal.

And then the big profit period will come and make the money for you. The experience of the best stock traders and investors is that 30% of trades being profitable is enough to achieve break-even results. And 50% profitable trades means that such trades could make huge monthly gains.

But the ratio of profitable to losing trades is not enough. There are also other critical elements that provide further help. They can prepare and manage trades to avoid big losses. And big loss is something that everybody wants to avoid.

Risk management

This is one key term for traders that is often mentioned. It is not much discussed in regards to investing. But I think it has similar importance for long term investors and also active investors as it has for short term traders.

Managing the risk for every individual position or trade is critical. Without proper risk management it is almost impossible to achieve the long term goal of profitable results.

The key for market terminology is risk reward ratio. Every trade should be prepared in accordance with this simple concept that use probabilities and statistics.

Money Management

Another key element in trading and investing is to properly use money that is available on your electronic stock trading account. Proper usage of available funds with knowledge of how to utilize margin is important knowledge for every trader or active investor.

Final words about these stock trading terms

Good traders and investors understand that losses will occur. But what makes best and profitable traders is how they are able to manage these losses and how they avoid big losses in their trading activities.

Find more on related pages

- How to improve every day stock trading results

- How to sell stocks with biggest gain

- Learn more about best ways to invest money