European stock trading is a good alternative to U.S. trading. The most popular European exchanges are in Frankfurt and London. European market trading on these exchanges is very similar to this activity on the NYSE or NASDAQ.

So, if you’re want to trade in Europe, I recommend to select the London exchange or buy/sell shares in Germany. The volume and the list of stocks available on these exchanges is good for any type of traders or active investors. Here are some facts I collected about trading on European exchanges and about trade execution on European markets.

Opening and closing times for european stock trading markets

London stock exchange trade hours are Monday – Friday, 8:00 am – 4:30 pm GMT

Frankfurt stock exchange , hours for traders are Monday – Friday, 9.00am till 5.30 p.m. CET for XETRA (electronic platform) and 9.00 a.m. to .8.00 p.m. CET for trading floor

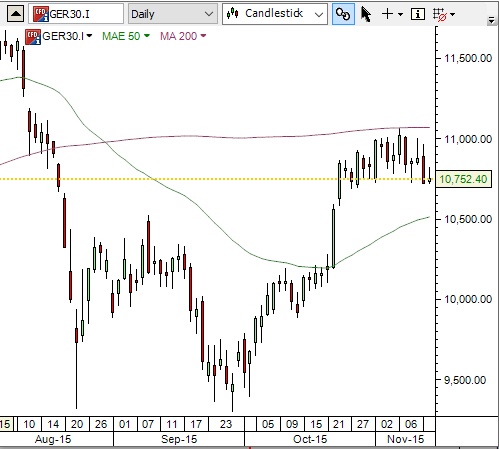

DAX index chart

Broker for european equity markets

There are European brokers and also International brokers that offer trading on European exchanges. It’s also possible to trade European stocks as CFDs (Contracts for Difference). I can recommend Interactive brokers or Saxobank for European stock trading. I have really a good experience with them.

The selection between these two could be based on your country. If you are in US or is your main currency is USD then you could prefer Interactive Brokers. But if you want to have account opened in some emerging market currencies then it could be better to select SaxoBank.

Very good option is to have account opened with both of them. One account to use as primary account and second as backup account.

How to find London shares quotes and/or German equity prices

The simplest way is to watch these prices on the Yahoo finance portal, where you can find all stocks from these two most important European markets. There are also real-time data vendors that provide real-time data from European exchanges.

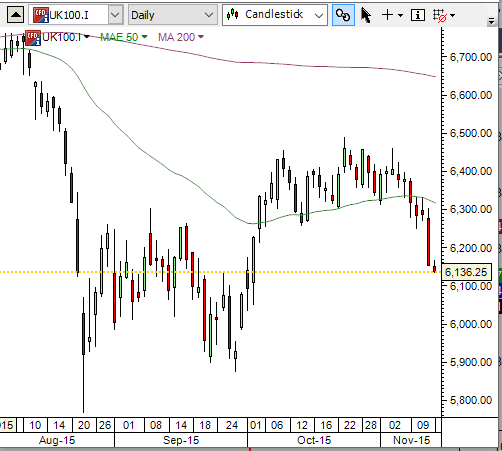

FTSE UK 100 index chart

Such data is easily downloadable into AmiBroker, the technical analysis software I use and I can only recommend.

I personally prepared my own AmiBroker database for the London exchange. I have members of all sectors of FTSE-350 and FTSE ALL shares indexes there.

Other points related to trades executed on european markets

What are most important European market indexes ?

FTSE-100 index for the London exchange (LSE) and DAX for the Frankfurt exchange (Deutsche Boerse)

Can I use the same simple systems I use already for U.S. stock trading?

I think yes. If your system is based on technical analysis, then it’s possible to use it also to trade European stocks.

Why are London and Frankfurt exchanges the best choices in Europe?

They offer enough symbols to trade. Also the trade volume for these European stocks is high enough to use for short-term strategies.